1Cover show you how to find the right travel insurance, at the right price, no matter where you're going.

We believe travel insurance should be simple, affordable and provide you with the coverage you need so you can enjoy your trip. In this guide we’ll show you how to find the right cover, at the right price, no matter where you’re going. If you want to compare credit card travel insurance, check out our comprehensive guide.

Keep It Simple

Keep It Simple

Buying insurance can seem intimidating, but it shouldn’t be! We want to make buying travel insurance as breezy and hassle free as possible.

Save You Money

Save You Money

We want to help you save money on your insurance, so you can spend it on the good stuff, like enjoying your trip!

Peace Of Mind

Peace Of Mind

When you’re travelling you want to feel secure in the knowledge that you’ll be looked after if something goes wrong.

About Us

About Us

At 1Cover, we’ve been in the travel insurance industry for over 20 years. We’ve been trusted by over 2 million travellers worldwide to look after them on their trips, so if there’s one thing we know, its travel insurance.

You can’t put a price on your safety, but there are a few tricks to help you save some serious dollars on your travel insurance, without compromising the quality of your cover.

A little know-how can go a long way to help save you money, so we’ve put together a list of the easiest ways you can save on your travel insurance.

Next time you’re purchasing travel insurance, ask yourself;

This seems obvious, but the simplest way to save money on your travel insurance is to go with a competitively priced provider. But don’t be fooled, being competitive means more than having the lowest premiums.

Have you considered these important questions?

Companies that provide different cover levels allow you to be insured for the things you need, without paying extra for things you don’t. 1Cover gives you the choice of Medical Only and Comprehensive cover levels for overseas policies.

Policies with the lowest premiums may also have the lowest cover limits. If you’re on the hunt for the cheapest insurance, be sure that the cover limits are adequate for you. All 1Cover policies provide unlimited cover for overseas medical assistance.

Be sure to take into account the cost of your excess when looking at the cover limits, it’s easy to get caught out. If your policy has a cover limit of $1000 for theft of cash, but the excess on this is $500, the maximum you will get back from your claim is $500.

Travelling with kids can increase the cost of your travel insurance. 1Cover provides cover for dependants under 19 years and not working full time who travel with a parent or grandparent for 100% of the journey at no additional cost on single and family policies.

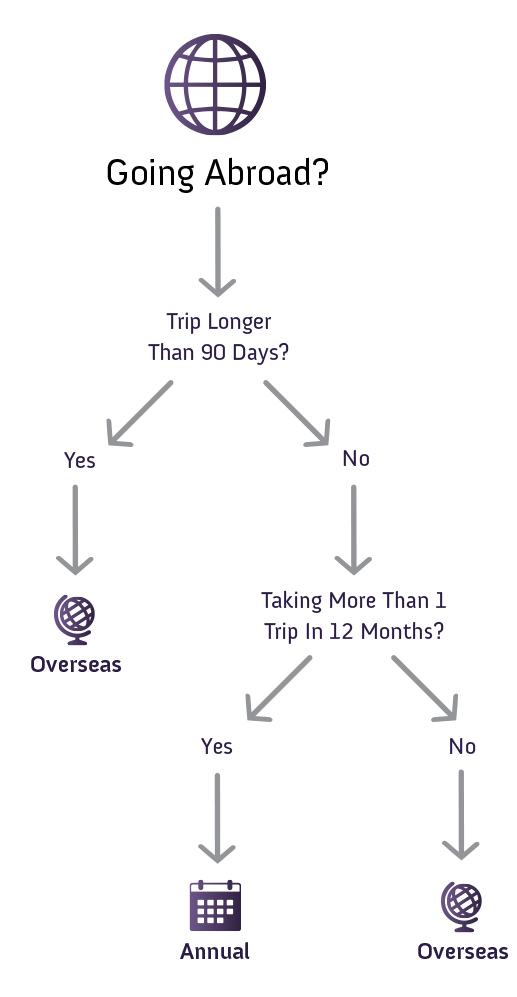

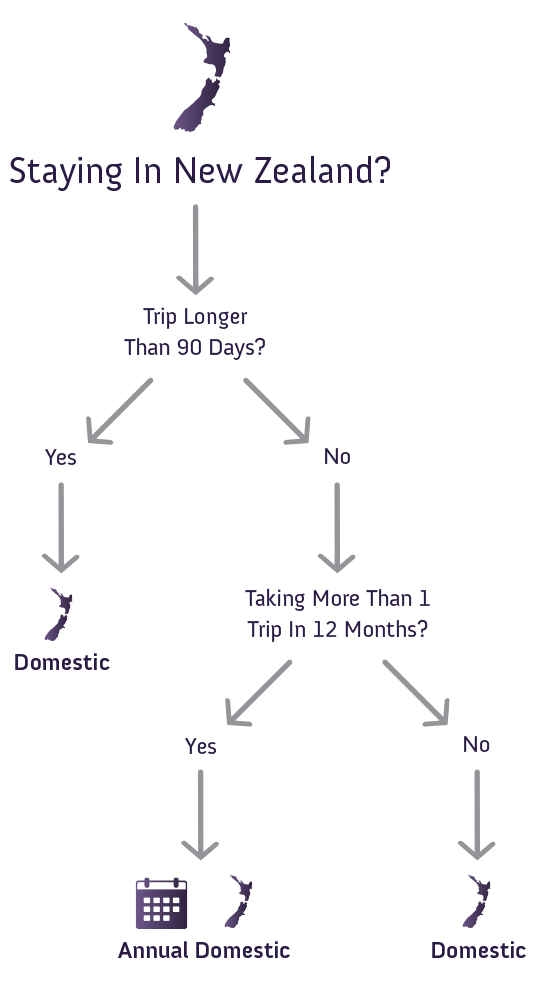

Annual policies are a great way to save money on your travel insurance, especially if you are a frequent traveller. Annual policies are not for long term travel, but provide you with cover for multiple short terms trips over the space of a year. Depending on the destination, 1Cover’s annual policies cost only slightly more than a single trip policy, but cover you for an unlimited number of trips during a 12 month period. We offer two different Frequent Traveller policies - Frequent Traveller 21 Days, or Frequent Traveller 45 Days. Each individual trip you take during the year can be no longer than the duration stated in your policy type.

Take our test and find out what type of policy is right for you.

Where you can get cheap travel insurance from depends on two main considerations;

The cost of travel to certain destinations varies greatly, and the same can be said of the cost of insurance. We show you what regions are the most expensive to be insured for, and which are the cheapest.

Which provider you choose will also affect the cost of your travel insurance. And while it’s easy to price match between companies, we show you what else you should look for when purchasing a policy to ensure you have peace of mind on your next trip.

Check to see that your insurer is underwritten by a company you know and trust.

You want to know the same people who sold you your policy will be looking after your claims as well.

Check the quality of your provider's online customer reviews, these can tell you a lot about their claims and customer service.

Your insurer should have a 24-hour emergency helpline for when you need them most.

How long has the provider been operating for? And is travel insurance the primary focus of their business?

Travel insurance generally only provides cover for unforeseen medical events, so if you have pre-existing conditions these may not be covered.

Insurers have different ways of assessing the cost of covering your pre-existing condition. Be sure to raise this issue with your chosen provider when purchasing a policy.

If your pre-existing condition cannot be covered, you can still get travel insurance. It might just mean that:

You can obtain travel insurance, but if you want your medical condition to be covered, you'll need to pay; or

you can obtain travel insurance but it will be mandatory to purchase coverage for your medical condition; or

your medical condition won't be covered at all, but you can still purchase travel insurance.

Please note, there's a possibility we might not be able to cover you at all, but we will tell you this during your medical assessment.

It’s no secret that as you get older, the price of your travel insurance can start to really skyrocket. At 1Cover, we believe that age should never stop you from travelling, after all, you’re only as young as you feel! Check out our top tips for how seniors can save money on your travel insurance.

We use the age of a traveller at the date of purchase, not the date of departure to detirmine the cost of insurance. This means that you could purchase a policy a policy up until the day before your birthday and be quoted at a lower rate.

You need to include all destinations you're travelling to, apart from stopovers of less than 2 night - except the USA. If you're travelling to the USA for any part of your journey then you need to include it in the destinations you are traveling to.

If your children or grandchildren are travelling with you for 100% of the journey and are under 19 and not in full-time employment, they can be added to your policy at no additional cost.

No. At 1Cover, we understand that accidents happen, and we would never penalise you for making a claim, no matter how big or small.

Unlimited cover for cancellations fees and lost deposits is included in all comprehensive policies.

No matter whether you’re travelling during your semester break, going on a gap year or setting off on an exchange, we can help you save money on your travel insurance. We understand that most students have to work on tight budgets, so check out our Medical Only policy.

Our basic policy has been designed especially with students and budget-conscious travellers in mind. We’ve included all of the medical assistance and expenses cover of our comprehensive policies, without any extras to keep your premium as low as possible.

Check out the coverage offered by our Medical Only policy below;

| Policy Benefits | Medical Only | |

|---|---|---|

Emergency | ||

| 24/7 Emergency Assistance Service | included | |

Medical | ||

| Overseas Emergency Medical & Hospital Expenses | SO | unlimited |

| Dental Expenses | O | $1,000 |

| Repatriation Of Remains | O | $25,000 |

Other | ||

| Personal Liability | P | $5 million |

Benefits shown are a summary of cover only. Sub-limits may apply. Please read the Policy Wording for full terms, conditions, limits, excess payable and exclusions to determine whether our travel insurance is right for you. S Sub-limits apply. P Limits are per policy regardless of the number of persons the claim relates to. O There is no cover while travelling in New Zealand. |

||

Your complimentary university travel insurance may cover you for travel during the semester, but if you plan to do any travelling outside of term time, or to countries other than where your exchange is taking place, then you may not be covered.

As specified by European Law since June 2004, it is compulsory to have travel insurance for visa application for Schengencountries. This includes at the time of application, the applicant must have a valid travel insurance policy which covers for repatriation and medical evacuation.

See the Schengen Visa Info site for up to date information.

Medical Only policies do not provide cover for luggage, so you will need to purchase a comprehensive policy. Our comprehensive policies provide cover for laptops, handheld computers, cameras and video cameras.